This text is an on-site model of our Unhedged publication. Join right here to get the publication despatched straight to your inbox each weekday

Good morning. Earnings season has handed its first hurdle — large financial institution earnings on Friday have been nice (although we’re nonetheless ready on Goldman and Financial institution of America, tomorrow). Subsequent hurdle: large tech, beginning with Tesla and Netflix on Wednesday. However observers of the US economic system will discover a lot to consider in some smaller firms this week: the trucker JB Hunt, the grocery store Albertsons, Snap-on instruments, assorted regional banks. Tell us what you’re watching and why: robert.armstrong@ft.com and ethan.wu@ft.com.

Staples shares as bond substitutes

Generally I overthink issues. Final week I wrote about my puzzlement concerning the extraordinarily poor efficiency of client staples shares since Could. Flight to security in reverse? Price sensitivity of staples demand? Food regimen medication reducing demand for affordable energy? Not one of the explanations, even together, appear fairly passable.

A number of readers wrote to level out I had missed an apparent candidate: staples shares are a bond substitute, and as bond yields have risen to enticing ranges, substitutes are not vital. That is significantly compelling provided that underperformance of staples started at about the identical time that bonds started to supply constructive actual yields, and has continued as actual yields have risen additional.

That is extra interesting than the opposite explanations. I feel the rationale that I didn’t consider it within the first place is that staples shares have been costly lately and, correspondingly, their dividend yields haven’t been significantly compelling. Again in Could, when the staples sell-off started, yields for S&P 500 staples have been about 2.5 per cent on common, solely a bit higher than the broader market. Within the basic bond alternate options, utilities and actual property, yields have been over 3 per cent and 4 per cent, respectively.

What’s a bond substitute, anyhow? It could possibly be a supply of yield — but in addition of security, or diversification, or some mixture thereof. The three are usually not the identical.

Within the horrible 12 months 2022, when shares and Treasuries have been positively correlated and each fell onerous, staples might not have supplied a lot yield, however they supplied security. And as quickly because the inventory/bond correlation reversed within the spring of 2023 (with shares rising and bonds falling) that ended:

When actual yields are considerably constructive, there’s much less purpose to personal staples as a hedge in opposition to downward inventory volatility. So if the period of zero or detrimental actual Treasury yields are behind us, is the period of premium valuation for staples shares over?

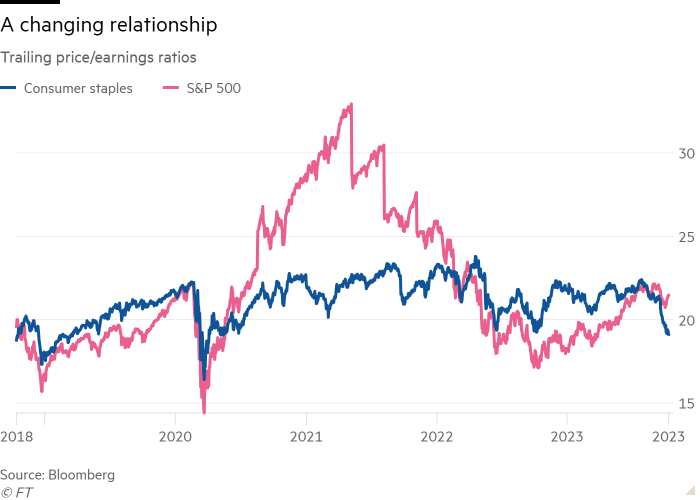

Under are the value/earnings ratios of staples and the S&P over the previous 5 years, which reveals staples buying and selling at a premium besides within the rocket-like restoration of 2020-2021, when riskier, growthier shares outperformed (an analogous sample emerged in the course of the dot.com bubble). These mid- and late-cycle staples premiums could also be a factor of the previous:

Financial tightening and the availability aspect

Tight financial coverage hurts demand. What does it do to provide?

Economists’ conventional reply: not a lot. The standard view is that financial coverage is a device of demand administration throughout the enterprise cycle, with few to no lasting results on provide. From the vantage level of a financial policymaker, provide is about exogenously, influenced by such uncontrollable inputs as laws, taxes and productiveness. The view, articulated by Milton Friedman half a century in the past, boils all the way down to “potential output is impartial of financial coverage”, because the economist Olivier Blanchard wrote in 2018.

One might have a look at this cycle and argue this appears about proper. After a lag, traditionally quick financial tightening is having its desired impact. Rising auto and bank card delinquencies weighing on gross sales for client staples are the latest merchandise in a listing that features depressed present house gross sales, extra company defaults and contracting earnings. In the meantime, provide has recovered from exogenous pandemic disruptions and seems largely unaffected by excessive charges. Official estimates of the US economic system’s “potential” (ie, most sustainable GDP progress) recommend we are going to emerge from each the pandemic and the tightening cycle broadly unscathed:

However the view that financial coverage is about demand administration, with few implications for provide, is coming underneath query. Some economists are questioning if financial coverage’s supply-side results have gotten ignored.

In a paper offered on the Fed’s Jackson Gap convention in July, Yueran Ma and Kaspar Zimmermann argue that price will increase might hamper the availability aspect by lowering funding in innovation. This occurs in two methods: by means of demand and thru financing. By decreasing finish demand, tighter financial coverage makes it tougher to search out prospects for brand spanking new merchandise, maybe killing a undertaking within the crib. And by elevating the risk-free price, tight coverage reduces traders’ incentives to again riskier, cutting-edge merchandise — the flip aspect of at this time’s common “T-bill and chill” funding technique.

Innovation funding is tough to measure, so the authors have a look at every part they’ll, together with nationwide funding in mental property merchandise, early- and late-stage VC offers and public firms’ quarterly R&D spending. Most curiously, they have a look at how financial coverage impacts patent filings for applied sciences labeled as disruptive, primarily based on whether or not the underlying tech is a frequent point out in firms’ earnings calls. Throughout all measures, the authors discover that much less is spent on innovation funding within the years after a 100bp enhance in charges. The decline is very pronounced for VC funding, which declines as a lot as 25 per cent inside three years. Patenting in disruptive tech falls as much as 9 per cent.

Ma and Zimmerman’s work factors to 1 potential hyperlink between tightening and the availability aspect. By decreasing innovation funding, long-term productiveness drops, pushing output down. However does this concept match the empirical file? One other current paper, revealed by three San Francisco Fed economists, seems on the relationship between tightening and long-run financial exercise the world over since 1900. They discover that tightening hurts progress over time by weighing on productiveness and capital accumulation:

The Fed economists argue that is finest defined by charges throttling R&D funding and spotlight a merciless asymmetry of financial coverage. Whereas tightening depresses long-run GDP, financial loosening has no corresponding profit:

If these findings are clear sufficient, what they imply for the Fed is much less simple. Sure, VC funding and public company R&D spending has slowed this cycle. However taking this to imply the Fed must go simple on charges ignores institutional constraints. No different official actor is tasked with worth stability just like the central financial institution is.

Preston Mui, an economist at Make use of America who has written a superb weblog publish summarising this literature, argues that focused fiscal coverage to help innovation funding is what’s wanted. Fortunately, this seems to be taking place. As non-public sector R&D funding has fallen, the state has made up for it, after which some:

Mui factors out that “lots of the elevated authorities funding in R&D was Covid-related, akin to well being analysis expenditures, after which adopted now by power”. He expects the development to proceed as funds from the Chips Act and Inflation Discount Act kick in.

Maybe one lesson is that for all of the comprehensible hand-wringing about excessive deficits, large fiscal has large upsides, too. (Ethan Wu)

One good learn

Company diplomacy at Microsoft.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Take heed to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the most recent markets information and monetary headlines, twice every week. Make amends for previous editions of the publication right here.

Really useful newsletters for you

Swamp Notes — Professional perception on the intersection of cash and energy in US politics. Join right here

Chris Giles on Central Banks — Your important information to cash, rates of interest, inflation and what central banks are pondering. Join right here