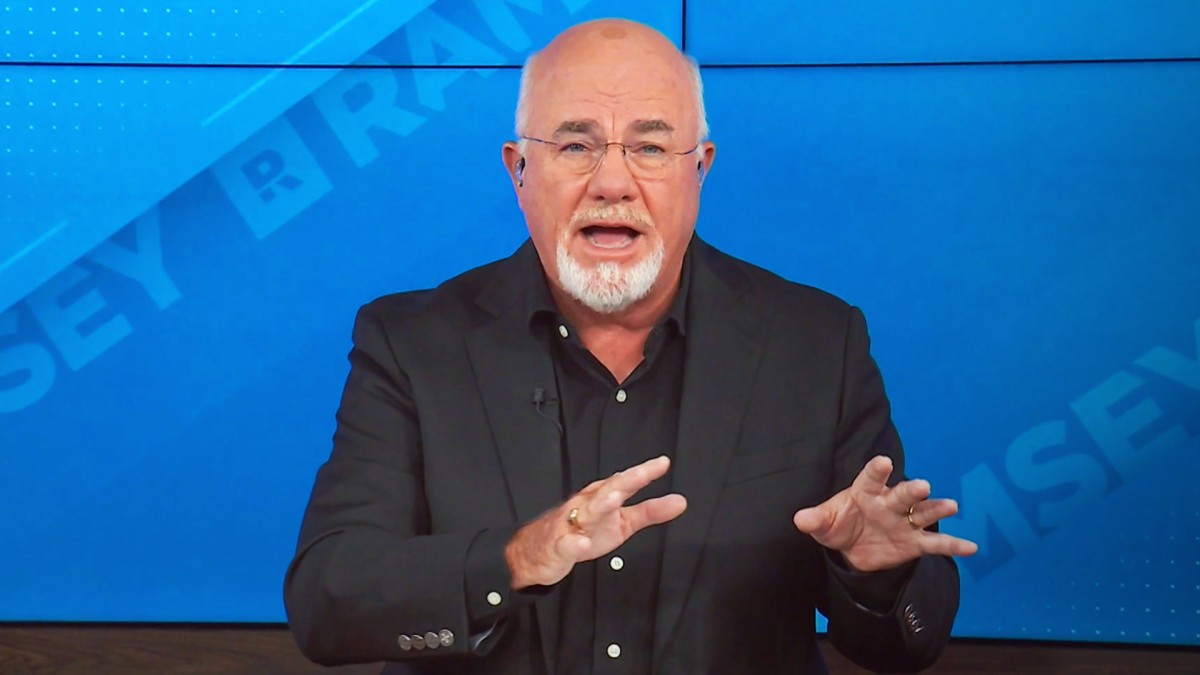

Bestselling creator and radio character Dave Ramsey spends numerous time encouraging folks to take management of their funds.

He suggests folks curious about severely managing their cash use a technique he is recognized that he calls child steps.

Associated: Shock chapter submitting ends a preferred luxurious model

Ramsey believes the infant steps (there are seven of them) can present folks how you can save for emergencies, repay debt and construct wealth. He says it isn’t a fairy story and that it really works each time.

Ramsey typically explains these steps in nice element, however here is a short abstract of them:

1. Save $1,000 in your starter emergency fund.

2. Repay all debt (besides the home) utilizing the debt snowball.

3. Save 3–6 months of bills in a completely funded emergency fund.

4. Make investments 15% of your family revenue in retirement.

5. Save in your youngsters’s faculty fund.

6. Repay your house early.

7. Construct wealth and provides.

TheStreet

An strategy to coping with life insurance coverage

An individual figuring out himself as Clay, who had been following Ramsey’s monetary recommendation, not too long ago requested him about an vital monetary challenge he had been grappling with.

“My spouse and I are each 36 years outdated, and we have now two youngsters,” he wrote, in response to KTAR Information in Phoenix. “Our son is six, and our daughter can be 4 subsequent month. We have been strolling by means of the Child Steps, and we should always have our dwelling paid off someday subsequent summer time.”

“We realized the opposite day the one factor lacking from our monetary image is life insurance coverage,” he continued. “We each work exterior the house. She makes $60,000 a 12 months, whereas I make $80,000 a 12 months. At our age, and in our present scenario, do you suppose we should always we get 20-year or 30-year degree time period life insurance coverage insurance policies?”

The private finance character started his reply by praising their efforts after which asking a key query.

“Pricey Clay,” Ramsey wrote. “You guys are doing an ideal job of getting management of your funds and planning for the long run.”

“Talking of the long run, do you intend on having extra youngsters?” he requested. “If you happen to do, you may wish to go together with 30-year insurance policies. If you happen to’ve determined two are sufficient, then based mostly in your current scenario I feel 20-year insurance policies would work out high quality.”

Ramsey amplifies on the maths concerned

Ramsey then defined the strategy he makes use of to determining how a lot life insurance coverage folks want.

“I like to recommend of us have 10 to 12 instances their annual revenue in life insurance coverage protection,” he wrote. “Which means you’d want between $800,000 and $960,000 in protection, whereas your spouse wants a coverage within the $600,000 to $720,000 vary.”

Ramsey instructed diving into the small print concerned on this state of affairs a bit additional.

“Your youngsters can be of their mid-twenties in 20 years,” he wrote. “Ideally, they each ought to have completed faculty by that point, or on the very least, be working and dwelling on their very own.”

“If you happen to proceed to observe my plan, you and your spouse can have paid off your house in a number of months and be utterly debt-free,” Ramsey continued. “And, you will have been saving 15% of your revenue for retirement over these 20 years. On common, that alone ought to provide you with greater than a half-million {dollars} for retirement.”

Ramsey appeared to admit to Clay that he was presenting these information on this style with a definite function in thoughts.

“Do you see the place I am going with this, Clay?” he requested. “Ultimately, you two will grow to be self-insured by getting out of debt, staying out of debt and piling up money.”

“So, in case you’ve received $500,000 or extra in a retirement fund, no debt and your youngsters are grown and out of the home, even in case you or your spouse had been to die unexpectedly at that time, the opposite would nonetheless be taken care of and in nice form financially,” Ramsey wrote.

“Sustain the nice work!”

Get unique entry to portfolio managers and their confirmed investing methods with Actual Cash Professional. Get began now.