Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

JPMorgan Chase reported a 35 per cent bounce in earnings for the third quarter, as the most important US financial institution continues to reap the advantages from greater rates of interest and decrease than regular mortgage losses.

The financial institution mentioned on Friday that web earnings climbed to $13.2bn, from $9.7bn a 12 months earlier. That was higher than the $11.9bn analysts had anticipated, in accordance with information compiled by Bloomberg.

JPMorgan’s chief govt Jamie Dimon mentioned the earnings have been “strong” however acknowledged that “these outcomes profit from our over-earning on each web curiosity earnings and under regular credit score prices, each of which can normalise over time”.

In a warning concerning the conflicts in Ukraine and Israel, Dimon mentioned this “would be the most harmful time the world has seen in a long time”. Dimon’s views on world affairs are carefully adopted throughout Wall Road.

JPMorgan’s shares trimmed an early achieve of greater than 4 per cent to shut 1.5 per cent greater in New York.

As with the earlier quarter, a lot of the achieve was pushed by web curiosity earnings, which at $22.7bn was 30 per cent greater than the identical quarter a 12 months in the past. The determine was forward of analysts’ expectations of $22.4bn, as JPMorgan continued to realize from the Federal Reserve’s cycle of rate of interest rises and the financial institution’s emergency acquisition of First Republic.

JPMorgan raised its web curiosity earnings goal for 2023, excluding its buying and selling division, from about $87bn to about $89bn.

Internet curiosity earnings is the distinction between what banks pay on deposits and what they earn from loans and different belongings. Massive banks corresponding to JPMorgan have been capable of cost extra for loans over the previous 18 months with out providing savers considerably greater charges for deposits.

In an extra increase to earnings, JPMorgan launched $113mn in reserves it had beforehand put aside for potential losses, confounding analysts’ estimates for the financial institution so as to add roughly one other $850mn to its reserves.

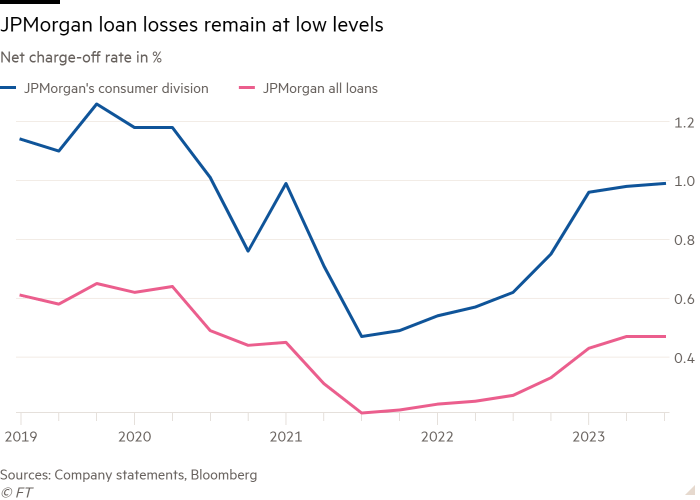

JPMorgan continued to profit from comparatively low losses on its loans within the quarter. Internet charge-offs — the portion of loans with losses which might be marked as unrecoverable — totalled $1.5bn, greater than double the identical quarter a 12 months in the past however solely up 6 per cent from the second quarter.

On an annualised foundation, JPMorgan wrote off 47 cents for each $100 it had loaned out, web of any recoveries it made.

Mortgage losses have been at traditionally low ranges because the early months of the Covid-19 pandemic due to authorities stimulus programmes. However though the Fed’s run of rate of interest will increase has boosted the earnings JPMorgan has constructed from making loans, there are worries that greater rates of interest will pile stress on debtors.

In an indication of the higher than anticipated credit score surroundings for US customers, JPMorgan lower its outlook for the online charge-off charge at its card providers enterprise from 2.6 per cent to about 2.5 per cent.

It additionally trimmed its steering for full-year bills from roughly $84.5bn to about $84bn.

JPMorgan reported funding banking charges of $1.7bn, down 3 per cent from a 12 months earlier however beating analysts’ estimates of $1.6bn.

JPMorgan, an business bellwether, is reporting earnings together with Citigroup and Wells Fargo. Financial institution of America and Goldman Sachs report outcomes on Tuesday, whereas Morgan Stanley experiences on Wednesday.