Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

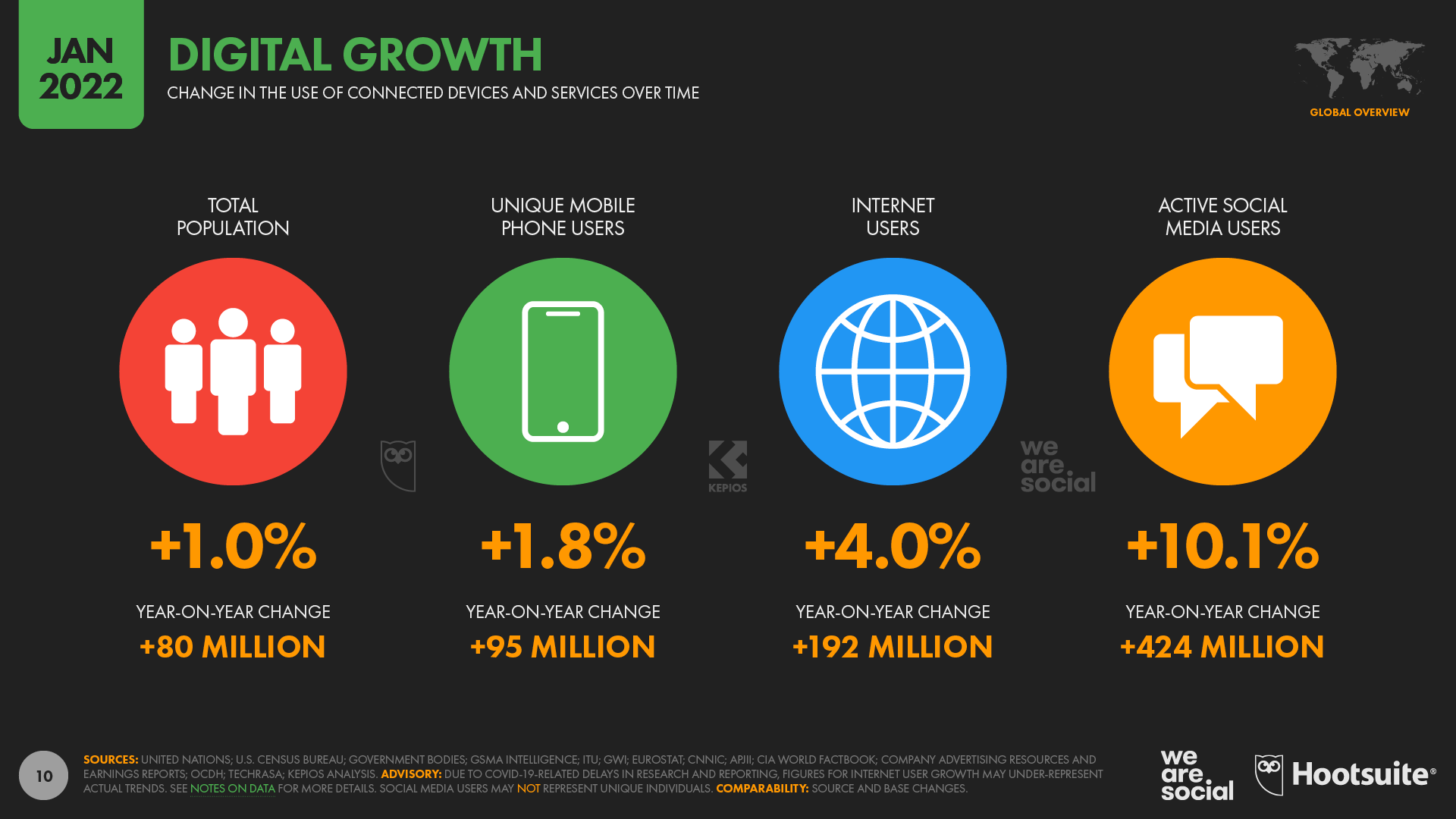

Lloyd’s of London has warned {that a} main cyber assault on a worldwide funds system might value the world financial system $3.5tn, as insurers and firms fear in regards to the systemic menace from hackers and whether or not the dangers are insurable.

The Lloyd’s market, which is a hub for cyber insurance coverage alongside conventional sectors reminiscent of delivery, stated a “hypothetical however believable cyber assault” would create “widespread disruption” to world enterprise.

The five-year financial affect can be felt largely strongly within the US, with $1.1tn of the loss, adopted by China with $470bn and Japan with $200bn in line with the situation, modelled by Lloyd’s in partnership with the Cambridge Centre for Danger Research.

Lloyd’s chair Bruce Carnegie-Brown stated the “world interconnectedness of cyber means it’s too substantial a danger for one sector to face alone”. He known as for the sharing of “information, experience and progressive concepts throughout authorities, business and the insurance coverage market to make sure we construct society’s resilience in opposition to the potential scale of this danger”.

Concern has risen amongst insurers and policymakers in regards to the menace to financial and nationwide infrastructure from cyber assaults. In December, insurance coverage group Zurich’s chief govt warned that cyber assaults had been on their strategy to changing into “uninsurable”.

Lloyd’s itself prompted controversy when it insisted on an exclusion in customary cyber insurance coverage insurance policies for large state-backed assaults. Banks and different suppliers of important companies feared this meant that they might not be lined within the occasion of such an assault, with the id of hackers and the query of state sponsorship tough to determine.

Some executives have pushed for a state backstop within the occasion of a wide-ranging assault or one which impacts core infrastructure. Insurers have held discussions with the UK authorities about whether or not Pool Re, the UK’s terrorism reinsurance scheme, could possibly be prolonged to cowl main state-backed cyber assaults.

The $3.5tn determine is a weighted common of three situations of various severity. Probably the most excessive of those envisages $16tn of losses over the interval, Lloyd’s stated.

Cyber insurance coverage is among the fastest-growing markets as corporations search for protection following a surge in ransomware assaults

Cyber premiums amounted to only over $9bn in premiums final 12 months, in line with Lloyd’s, and are predicted to achieve as a lot as $25bn by 2025.

Lloyd’s stated that this “nonetheless represents a small portion of the potential financial losses that companies and society face”.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24957782/cs_2.jpg)