The race to internet zero has led hundreds of companies to decide to eliminating their greenhouse gasoline emissions by 2050, a dedication that falls quick of what’s wanted to counter the rising local weather emergency.

The issues are manifold. Inadequate motion and planning amongst governments and firms is a part of it, however even with the most effective will on the planet, the Herculean endeavor required to get companies to internet zero in lower than three many years presents an enormous gamut of challenges.

Amongst them is easy methods to assist well-intentioned establishments put money into carbon initiatives, and — by extension — easy methods to assist carbon initiatives get funding? That is one thing that Opna is getting down to clear up, with a platform that helps firms discover, fund, and monitor carbon initiatives as a part of their offsetting endeavors.

The London-based firm, which rebranded from Salt some three months in the past, right now introduced it has raised $6.5 million in seed funding because it appears to attach initiatives with corporates looking for to deal with their emissions as a part of the so-called voluntary carbon market (VCM).

Absolutely vetted

Based in 2022, Opna serves as a direct artery for corporates to search out fully-vetted challenge builders, saving them money and time sourcing initiatives to fund as a part of their net-zero efforts. Moreover, Opna additionally helps facilitate the financing side by standardized processes and agreements, whereas enabling companies to watch their portfolio of initiatives over time by by key efficiency indicators (KPIs) and danger reporting.

In keeping with Opna founder Shilpika Gautam, the established order for carbon challenge discovery and financing is basically an arduous, guide course of with little in the best way of digitalization. And there’s little consistency throughout sectors, including to the due diligence difficulties.

“The processes and instruments are pushed by the sophistication and experience of firms, and the way business-critical their net-zero technique is,” Gautam defined to TechCrunch. “Probably the most ‘lively’ companies are swamped with emails from challenge builders — as the method is totally guide, it’s arduous for companies to inform good or dangerous or duplicate initiatives, leaving them to default to working with challenge builders they know.”

Opna’s founder Shilpika Gautam Picture Credit: Opna

On the challenge aspect, there are a variety of developer sorts, together with bigger personal gamers comparable to South Pole and Ecosecurities which have entry to their very own capital pool. After which there are small and mid-sized gamers that sometimes want to lift upfront financing to fulfil their carbon initiatives. It’s these latter ones that Opna is trying to assist, whereby a financier (i.e. a company) gives among the funding upfront with the promise both of future carbon credit, or commits to buy carbon credit when they’re delivered.

“We give attention to initiatives the place there are frameworks and requirements obtainable, and the place the science is extra identified,” Gautam stated. “In different phrases, the place we will actually give attention to tackling the financing problem.”

When it comes to enterprise mannequin, Opna plans to cost a set proportion on accomplished financing transactions, in addition to an annual subscription for monitoring, monitoring, and reporting in initiatives that change into financed.

In its 18 or so months since its founding, Gautam says Opna has signed up “tens” of challenge builders from around the globe who want upfront financing.

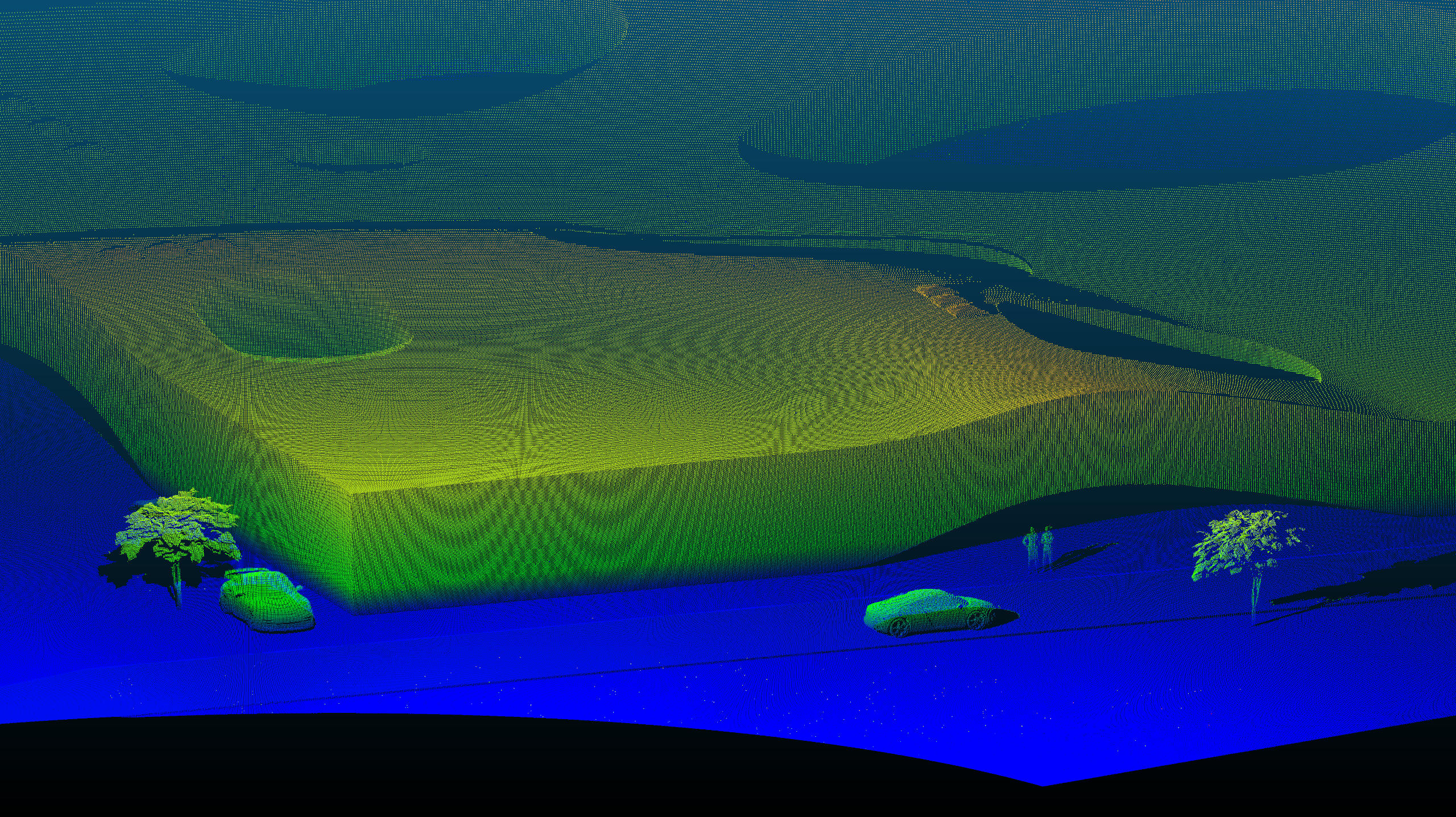

“We work intently with these initiatives, which vary from reforestation initiatives in South America, restoring degraded lands and conserving biodiversity, to biochar initiatives that create biofuels and obtain carbon elimination, throughout a number of international locations in Europe, Africa, and South Asia,” Gautam stated.

On the financing aspect, in the meantime, Gautam stated that Opna has been privately beta testing its platform with a number of enterprises throughout totally different sectors, although she stopped in need of naming names. However its newest money injection shall be substantively used to scale issues and increase buyer consciousness over the subsequent couple of years.

Carbon copy

There are a selection of gamers working within the Opna’s house, together with carbon elimination market Supercritical which not too long ago raised $13 million in Collection A funding. Nonetheless, Gautam stated that Opna is setting itself aside by not merely permitting firms to buy carbon credit which have already been generated, however as an alternative shifting additional upstream to assist get new initiatives off the bottom.

“Opna’s platform allows companies to straight finance carbon initiatives, method earlier than the initiatives generate a carbon credit score,” Gautam stated. “This can be a essential distinction, as a result of we at present have a provide scarcity of high-quality credit, and by financing initiatives in the beginning, companies assist carry them to life, thereby locking sooner or later provide of credit that these initiatives ultimately generate to match their net-zero objectives.”

Opna’s seed spherical was led by European VC Atomico, with participation from Pale Blue Dot, MCJ Collective, Angelinvest, Tiny VC, and a number of other angel buyers.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24016883/STK093_Google_06.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24931976/236794_iPhone_15_pro_pro_Max_VPavic_0020.jpg)