Europe has far too few VCs created by former founders, or “Operators” because the business usually likes to name them. Sure, Atomico has Niklas Zennström. Firstminute Capital has Brent Hoberman. Extra not too long ago Plural was created by Taavet Hinrikus (ex-Clever), Sten Tamkivi (ex-Teleport) and Ian Hogarth (ex-Songkick). However that “operator-turned-VC” checklist shortly runs out throughout the European tech scene.

However now that story switches to Bristol, England.

Harry Destecroix co-founded biotech startup Ziylo whereas finding out for his PhD on the College of Bristol. Ziylo, a college spin-out, developed an artificial molecule that binds to glucose in blood.

However to do that he determined he wished to be surrounded by like-minded ‘SciTech’ firms. So, in 2017 he launched Unit DX, an incubator, in collaboration with the College of Bristol, to commercialize firms like his personal.

Three years later, in 2020, Destecroix exited Ziylo to Danish agency Novo Nordisk — which had realized it might use Ziylo’s molecule to unlock a ‘good’ insulin — in a deal estimated to be be value over $800m .

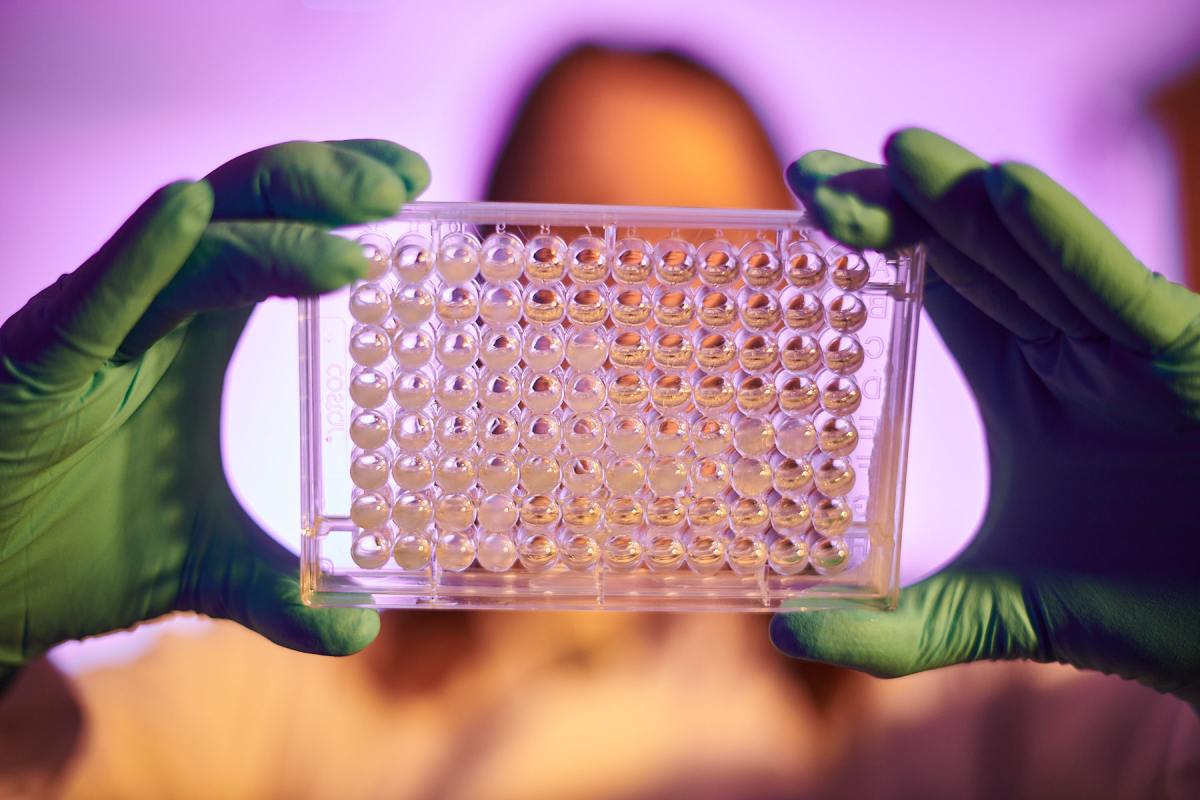

Destecroix used his exit to to repeat the train of making deep-tech, science-based startups, once more, in Bristol. He launched ‘tech ecosystem’ “Science Creates” consisting of the UnitX and Unit DY moist labs, and a £15 million funding fund with the College and a community of strategic companions.

Quick foward to right this moment, and Destecroix has now taken that journey additional with the launch of SCVC, which is now aiming to be a $100 VC million fund, and claims to have reached its first shut (at an undisclosed quantity). The Bristol-based agency will spend money on deeptech round well being and local weather.

Over a name Destecroix instructed me: “It’s been two years and I really feel just like the extra I’ve invested, the extra I’ve obtained hooked on it. It’s been a beautiful journey. And I additionally really feel there’s not sufficient founders within the UK that ended up going into enterprise. So we wish to construct we wish to construct a enterprise fund that’s actually founder-led.”

SCVC’s first $17 million Seed fund (previous to the change to full-blown VC) backed 12 firms starting from therapeutics and diagnostics to quantum sensors and semiconductors.

Latest investments embrace ‘Delta g’ (quantum gravity sensors) and Isomab (biotech), and Scarlet Therapeutics (purple blood cell-based therapeutics).

The brand new fund will make investments at pre-seed and seed stage with preliminary cheque sizes of $500k as much as $3m. It can additionally present follow-on funding of Sequence A tickets as much as $7m.

The fund’s first funding is VyperCore, RISC-V start-up growing modified processors.

Destecroix is joined by SCVC cofounder Jon Craton, an Angle investor and former co-founder of Zynstra which was was acquired by NCR Company.

Bristol-based founder John Williams, co-funder of the floated Kudan (synthetic notion applied sciences) joins because the agency’s first Enterprise Companion.

Destecroix defined: “What we do is we specialise within the 1% of startups that come from science, that appear loopy to the skin world. What do you imply you might want to elevate thousands and thousands of kilos? What do you imply you don’t even know what your product is like? This. Such a startup is loopy to most individuals who run typical companies. So in fact you might want to wrap round them a really distinctive and particular set of ability units.”

Previous to the current information that the UK could be re-joining the EU’s Horizon science funding programme, Destecroix criticised Brexit.

“I positively assume it hasn’t helped,” he stated. “It’s made it more durable to fund a fund by way of European traders… I really feel like we should be a part of these larger buying and selling bloc’s to return collectively to actually go after a few of these very large points like vitality and AI.”

Nonetheless, he backed the UK’s strategy to AI: “I believe the EU is over-regulating it and I believe UK is taking a way more nimble strategy. I’ve heard from startups from France who’re considering of transferring to the UK. We have to consider AI being utilized to every little thing: authorities, life sciences, healthcare.”

The information of SCVC can be a shot within the arm for Bristol’s booming tech scene which already boasts firms resembling Ultrahaptics, Open Bionics, Graphcore and Immersive Labs.