Obtain free Hedge funds updates

We’ll ship you a myFT Day by day Digest electronic mail rounding up the most recent Hedge funds information each morning.

One factor to start out: The top of Lazard in Sweden has been charged with aggravated bribery linked to a takeover of a Swiss firm by engineering group Atlas Copco.

Welcome to Due Diligence, your briefing on dealmaking, non-public fairness and company finance. This text is an on-site model of the e-newsletter. Enroll right here to get the e-newsletter despatched to your inbox each Tuesday to Friday. Get in contact with us anytime: Due.Diligence@ft.com

In in the present day’s e-newsletter:

-

Multi-manager hedge funds on the rocks

-

Qatar bets on India’s Ambani

-

Turkey’s IPO renaissance

Multi-manager hedge funds meet their maker

Three many years in the past, when star merchants resembling George Soros, Julian Robertson and Paul Tudor Jones have been masters of the universe, a brand new era of companies started to crop up that regarded completely different to their predecessors.

These funds employed a ton of specialist merchants who got their very own profit-and-loss accounts and whose survival was predicated on the whims of the markets. Whereas their buying and selling was theoretically overseen by refined threat administration expertise, any supervisor who sustained massive losses might discover themselves jobless.

The so-called multi-manager technique was pioneered by Ken Griffin’s Citadel and Izzy Englander’s Millennium Administration. The 2 launched their companies inside a yr of one another and nonetheless dominate the trade three many years later.

However the enterprise mannequin they pioneered is now liable to changing into a sufferer of its personal success, DD’s Ortenca Aliaj and the FT’s Harriet Agnew report on this Large Learn, amid a fierce expertise warfare and rising rates of interest that eat into the wholesome returns they’ve been in a position to ship for buyers.

Over the previous 5 years particularly, multi-manager funds have emerged because the quickest rising and most worthwhile hedge funds on the scene.

Their diversified portfolios and skill to slash or elevate their stage of threat shortly gave them a key benefit throughout the pandemic when markets went right into a tailspin.

However multi-managers typically use large quantities of leverage relative to their friends to juice returns — a mean of greater than 5 instances their property, by Goldman Sachs’ calculations — on the guise that they’ll oversee threat.

That hasn’t meshed effectively with greater rates of interest, which have elevated the price of borrowing and compelled funds to spend more cash on producing the identical outsize returns.

And provided that these funds utilise a so-called pass-through bills mannequin, aka when a supervisor passes on all prices to their finish buyers slightly than an annual flat charge, buyers aren’t too jazzed about shouldering the additional prices.

The platforms’ fast development lately and a shortage of the form of specialised risk-takers who can deal with the job has additionally unleashed a fierce battle for expertise, driving pay for prime merchants sky-high and footing buyers with the invoice.

One hedge fund investor outlined the destiny of multi-managers into two situations: both “somebody will get pummelled . . . or they lose their edge”.

An uptick in “crowded trades” means these funds are inextricably linked whether or not they prefer it or not. A commerce gone mistaken might ripple throughout the market. Or, in a much less dramatic flip of occasions, the methods turn out to be so mainstream that earnings turn out to be unsustainable.

Even Griffin, whose final yr topped Bridgewater’s Ray Dalio as essentially the most profitable hedge fund supervisor of all time, acknowledged that the tip of an period could also be on the horizon.

“Clearly proper now the multi-strategy managers are very a lot in vogue. Whenever you’re hottest might be whenever you’re reaching the highest of the cycle,” he advised the FT.

Qatar to make an funding buy at Reliance Retail

On Monday, Mukesh Ambani spun off his subsidiary Jio Monetary Companies — the primary unit from his Reliance Industries empire to checklist in nearly 20 years — to restricted fanfare.

Regardless of the weak market debut, nonetheless, at the least one deep-pocketed investor is offered on the Indian billionaire’s broader technique. Qatar’s sovereign wealth fund is ready to take a position $1bn within the conglomerate’s purchasing arm Reliance Retail in a deal valuing it at $100bn.

Chances are you’ll bear in mind the FT reported that this deal was within the offing final month.

Led by Mukesh Ambani’s 31-year-old daughter Isha, Reliance Retail has expanded aggressively throughout the purchasing spectrum via a blitz of acquisitions. It has solid partnerships with worldwide manufacturers together with Chinese language fast-fashion firm Shein, and beat out Amazon in a scrap with its founder Jeff Bezos over a bankrupt Indian retailer.

Bulking up Reliance Retail will likely be important as Mukesh seems to diversify his industrial conglomerate and remodel it into India’s main digital group. It’s additionally key to his succession plan.

Hoping to keep away from a rerun of his messy cut up from brother Anil after their father’s loss of life, Mukesh Ambani is carving his enterprise empire into three interlocking however separable models — digital, retail and vitality — for every of his three kids.

Reliance’s annual common assembly on Monday, the place Ambani sometimes updates shareholders on his considering, ought to shed extra mild on plans to drift the trio of companies.

Retail merchants wager on Turkey

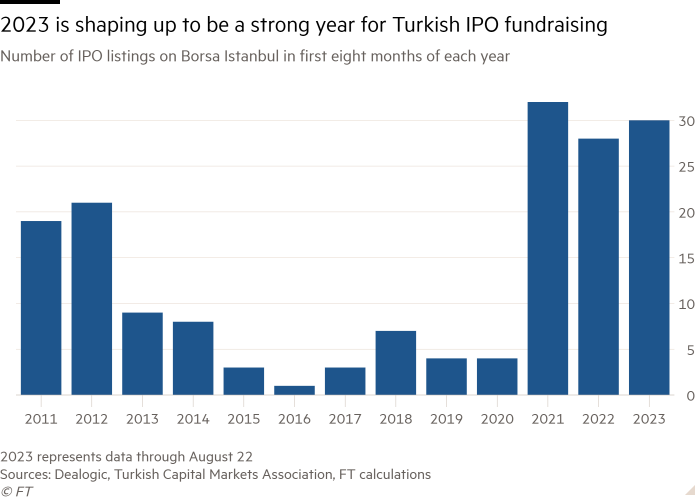

Whenever you consider the world’s hottest equities markets, Turkey could not spring to thoughts. However a retail buying and selling frenzy and scorching inflation have propelled Istanbul into the ranks of the most important bourses for preliminary public choices this yr.

Thirty corporations have offered shares in IPOs on Borsa Istanbul this yr, elevating $1.9bn collectively, in keeping with Dealogic information. Istanbul is forward of a lot bigger regional bourses on the 2023 league desk, together with London, Milan and Frankfurt.

Turkey is benefiting as native retail buyers turn out to be an more and more influential a part of the market. Whereas international capital has fled on considerations over President Recep Tayyip Erdoğan’s unconventional financial insurance policies, retail merchants have been turning to equities within the hope of incomes massive returns to offset the consequences of a long-running inflation disaster and a tumbling lira.

“Native turnover is extremely excessive now and that has contributed to the variety of listings out there,” mentioned Tunç Yıldırım, head of institutional fairness gross sales at Istanbul-based funding financial institution ÜNLÜ & Co.

Whereas $1.9bn in itemizing volumes simply trumps miserable figures in London, it gained’t do a lot for moribund total international IPO exercise.

Job strikes

-

Deutsche Financial institution has appointed BlackRock’s Stephen Fisher as international head of political affairs.

-

About 20 senior Credit score Suisse dealmakers in Europe are switching to UBS following its government-orchestrated takeover of its Swiss rival, per Monetary Information.

-

HSBC has employed Evercore’s Alex Hong to guide dealmaking in Singapore, per Bloomberg.

-

Snap has named former Google government Pulkit Trivedi as head for India as a part of a broader effort to develop its presence out there.

Good reads

Caught within the blaze The catastrophic wildfires in Maui have thrust Hawaiian Electrical into chaos. What may very well be the embattled utility’s most dear asset — Hawaii’s third-largest financial institution — is also a legal responsibility, The Wall Road Journal reviews.

Nerds within the wild West The New York Occasions chronicles how Jackson Gap, Wyoming — as soon as a go-to hideaway for outlaws — turned dwelling to one of many world’s most unique financial gatherings.

Cin cin From hyperdecanting to biodynamic blends, the FT’s wine knowledgeable Jancis Robinson solutions readers’ questions, together with those you could be embarrassed to ask your self.

Information round-up

Odey Asset Administration abandons Mayfair headquarters (FT)

FTX turns to Mike Novogratz’s Galaxy Digital to promote crypto tokens (FT)

GAM begins funding talks with buyers after Liontrust bid fails (FT)

Critical Fraud Workplace drops ENRC case after 10-year investigation (FT)

Engie strikes $1.6bn US battery take care of Apollo, EnCap (Bloomberg)

Ladies’s multiclub soccer pioneer in talks over first deal (Bloomberg)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Francesca Friday, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please ship suggestions to due.diligence@ft.com

Advisable newsletters for you

Scoreboard — Key information and evaluation behind the enterprise choices in sport. Enroll right here

Full Disclosure — Protecting you updated with the most important worldwide authorized information, from the courts to legislation enforcement and the enterprise of legislation. Enroll right here