Welcome to FT Asset Administration, our weekly publication on the movers and shakers behind a multitrillion-dollar world business. This text is an on-site model of the publication. Enroll right here to get it despatched straight to your inbox each Monday.

Does the format, content material and tone be just right for you? Let me know: harriet.agnew@ft.com

Final week my New York-based colleague Ortenca Aliaj and I revealed that Izzy Englander’s Millennium Administration is in superior talks to place billions of {dollars} to work with smaller rival Schonfeld Strategic Advisors. Such a partnership deal would mark the biggest of its sort within the $4tn world hedge fund business.

We adopted up with this deep dive, through which we defined the rationale behind a transaction — and the way this isn’t the primary time that the 2 teams have thought of teaming up.

Notably, they held casual discussions throughout March 2020 when the early levels of the pandemic unleashed turmoil on the markets. That month Schonfeld’s flagship hedge fund was down about 16 per cent and its prime brokers have been asking it to place up extra collateral, in response to a routine margin name as markets moved in opposition to it. One concept placed on the desk was for Millennium to supply some capital. Ultimately, talks by no means got here to fruition and Schonfeld managed to shore up its place.

Quick ahead three and a half years and Schonfeld’s capitulation to Millennium displays the altering fortunes of a hedge fund supervisor that has struggled to maintain up with massive rivals. Regardless of its robust long-term file, neither of Schonfeld’s two funds have made cash this yr, including to an underwhelming 2022 through which the agency lagged far behind the likes of Ken Griffin’s Citadel and Millennium.

It additionally illustrates a key dynamic of the “pass-through” bills mannequin that could be a defining attribute of the multi-manager platforms. As an alternative of an annual administration charge, the supervisor passes on all prices to their finish traders. The concept is that managers can make investments closely in areas equivalent to workers and expertise, with the associated fee greater than offset by the ensuing efficiency enhancements.

The multi-manager mannequin is considerably extra headcount-intensive than conventional hedge funds, and seems to have much less working leverage as companies develop larger. “As property scale, headcount (and with it their value base) tends to develop on a linear foundation,” mentioned a report final yr by Goldman Sachs prime brokerage.

However crucially, if the amount of cash a agency manages declines, prices don’t fall in step with the lower as a result of it’s laborious for managers to chop spending on the identical tempo. Meaning fewer traders find yourself footing a bigger invoice that eats into returns, which may set off additional cash being pulled out.

A chief dealer explains it like this:

“If property begin getting redeemed, the traders which might be left behind get left with the brunt of the prices. Purchasers are going to need to redeem rapidly and never get caught. You don’t need to be the final particular person left holding the bag.”

Taking a look at Schonfeld, its property have doubled prior to now two years, from about $6bn to $12bn. And its headcount has grown from about 600 to greater than 1,000. The difficulty for Schonfeld is that whereas its property and value base have surged, it hasn’t put up the efficiency figures to match.

Learn the complete story right here. And it is likely to be price reminding your self of our Large Learn from August, through which we discover whether or not multi-manager funds have gotten a sufferer of their very own success.

ESG rankings: whose pursuits do they serve?

As demand for ESG danger knowledge has ballooned in measurement over the previous decade, the likes of MSCI, Morningstar and S&P have acquired appreciable energy to affect and in some instances dictate which shares and bonds find yourself within the $2.8tn or so of funding funds which might be marketed as sustainable.

But it surely seems {that a} product meant to make traders’ lives simpler has in actual fact left them annoyed with the extent of chaos and confusion it creates, writes my London-based colleague Kenza Bryan on this must-read Large Learn.

An absence of regulation across the high quality of those scores has led a wide range of issues to set in, specifically round accuracy, transparency and conflicts of curiosity. The European Fee, for instance, thinks that ESG scores are tormented by conflicts of curiosity. There’s the sale of rankings, knowledge and indices to the identical investor shoppers, in addition to the sale of consultancy providers to assist corporations enhance their rankings, and the apply of charging corporations to show their very own score on monetary merchandise.

As Kenza explains, scores are principally paid for by traders, not issuers. However consultancy providers to assist corporations enhance their rankings are nonetheless widespread.

Daniel Money, a credit score rankings specialist at Hong Kong regulation agency Ben McQuhae, compares this case to how credit standing companies operated earlier than the 2008 monetary disaster, which drew the eye of regulators to the potential for rankings to be skewed in direction of paying shoppers. “They have been utilizing consultancy providers as money cows and primarily the score companies are doing the identical factor,” he says.

An extra potential downside for the business is the hole between the notion of what ESG rankings assess and what they really show.

“There may be disillusion and confusion when individuals realise the labels imply little or no or don’t measure what they need them to measure,” says Fabiola Schneider, an assistant finance professor at Dublin Metropolis College. “And you’ve got traders attempting to use that confusion and entice capital by showing greener than everybody else.”

Information suppliers insist they’re impartial conduits for info — not standard-setters. Learn the complete story right here and see when you agree . . .

Chart of the week

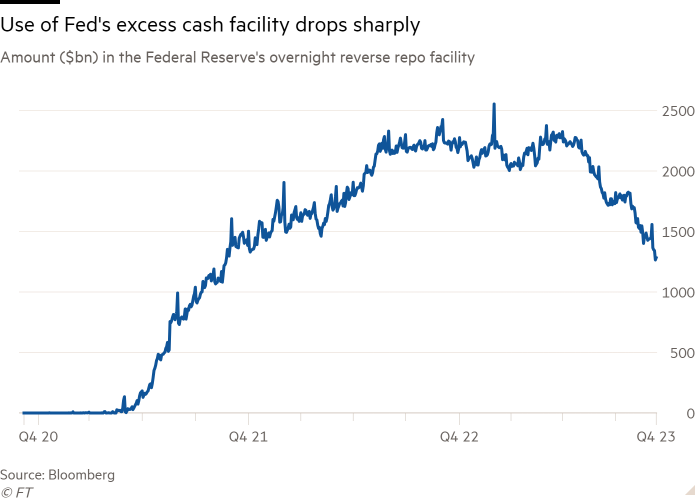

Use of a Federal Reserve facility for storing money has halved from its peak as cash market funds plough their extra funds into US authorities debt as an alternative, writes Jennifer Hughes in New York.

Traders on Friday put $1.28tn into the Fed’s in a single day reverse repo facility (RRP), the place money is saved risk-free for a brief interval for a beneficiant return. The overall was near the bottom degree in two years, half of its $2.6tn peak and a drop of greater than 40 per cent since Might.

Till this yr the file day by day inflows of greater than $2tn into the RRP have been thought of an indication of market uncertainty, implying that US cash market funds that spend money on authorities debt most popular the security of the Fed over the volatility of bonds.

The ability was established completely in 2014, and is designed to suck up extra money within the monetary system.

Nevertheless, the incentives for traders have flipped in latest months, pushed by knowledge that time to a resilient US economic system. That has pressured merchants to rethink their views on how lengthy the Fed will hold rates of interest elevated to curb inflation.

Consequently final week tumbling bond costs pushed yields on benchmark 10-year Treasuries to a 16-year excessive of almost 5 per cent.

Larger yields have elevated the attractiveness to traders of cash market mutual funds, notably as charges from competing merchandise equivalent to financial institution deposits have did not hold tempo with rate of interest strikes.

A file $5.7tn presently sits in US cash market funds and the huge bulk of the inflows, price $64bn, flowed into authorities funds, in accordance with weekly knowledge launched on Thursday.

5 unmissable tales this week

Japan’s prime minister Fumio Kishida has appealed to BlackRock founder Larry Fink and others controlling $18tn of property to spend money on Japan’s future, wrapping up a appeal offensive to lure capital into the nation. Prime managers from the likes of KKR, Blackstone, GIC, Norges Financial institution and Temasek have been hosted final week by Kishida throughout a “Japan Weeks” authorities marketing campaign. The message was that world traders ought to lastly flip bullish on the world’s third-largest economic system.

A sell-off in world bond markets has pushed borrowing prices to their highest ranges in a decade or extra. Meaning probably heavy losses for banks, insurers, pension funds and asset managers that personal trillions of {dollars} of sovereign and company debt after loading up in recent times. Don’t miss our deep dive on the elements of the monetary system that might come below pressure.

US tech investor Basic Atlantic and French asset supervisor Carmignac are backing a London funding supervisor that’s shopping for out stakes in non-public fairness funds, as they search to diversify into this fast-growing technique. The pair have purchased minority holdings in Clipway, a agency arrange by former Ardian senior investor Vincent Gombault.

The household workplace of secretive billionaire Harald McPike has accused US gaming investor Jason Ader of fraudulently inducing it into backing his particular function acquisition firm as a result of he was below strain to return $16mn to his mom.

Vontobel has named two inner candidates to collectively lead the group when present chief government Zeno Staub steps down in April. Georg Schubiger, head of wealth administration, and Christel Rendu de Lint, head of investments, will grow to be co-CEO of the Swiss funding supervisor from January.

And eventually

Within the early nineteenth century famend British architect Sir John Soane designed and constructed Pitzhanger Manor as his dream nation retreat in then-rural Ealing. Properly Ealing is now not rural, however the neoclassical home stays as placing now because it should have carried out again then. Pitzhanger Manor and its accompanying gallery have simply unveiled an emotionally charged new exhibition fearing the work of British up to date artists Idris Khan and Annie Morris. Throughout the 2 areas over 30 works of sculpture, images, portray and embroidery are superbly juxtaposed with Soane’s home areas. Curated by Maya Binkin. On till January 7.

Thanks for studying. When you have mates or colleagues who may get pleasure from this text, please ahead it to them. Enroll right here

We’d love to listen to your suggestions and feedback about this text. E-mail me at harriet.agnew@ft.com

Really helpful newsletters for you

Due Diligence — Prime tales from the world of company finance. Enroll right here

The Week Forward — Begin each week with a preview of what’s on the agenda. Enroll right here