This text is an on-site model of our Unhedged publication. Enroll right here to get the publication despatched straight to your inbox each weekday

Good morning. That is the third and remaining leg of Unhedged’s newest collaboration with geopolitical renaissance man Adam Tooze, of Columbia College (you probably have not executed so already, subscribe to his publication, Chartbook). Tell us your ideas, on India or anything: robert.armstrong@ft.com and ethan.wu@ft.com.

Unhedged: the funding case for India

The struggle in Gaza has deepened the sample of world polarisation that first grew to become painfully obvious with the invasion of Ukraine. As President Joe Biden arrived in Israel yesterday, Vladimir Putin appeared in Beijing. More and more, China, Russia and Iran appear to be an authoritarian bloc that exists in stress with America, the western democracies and their allies.

Crucial nation standing between these poles is India. Prime Minister Narendra Modi is commonly counted among the many world’s nationalist sturdy males, but he leads the world’s largest democracy. The leaders of the democratic world, as they edge away from China, are eager to deepen ties with India, as each a strategic counterweight and financial associate. On the similar second, international companies and buyers are making an identical flip to India. From an FT editorial over the summer time:

India’s rising position within the international economic system is certainly turning into tougher to disregard. In April, it overtook China because the world’s most populous nation. The IMF expects its economic system to develop over 6 per cent this 12 months, and buyers more and more see the nation as a substitute for China . . . Optimism surrounding India’s economic system has boomed this 12 months. Its inventory market has surged as international buyers have purchased into its nationwide development story. Multinationals have proven an curiosity in shifting manufacturing to the nation as a part of “China plus one” diversification methods

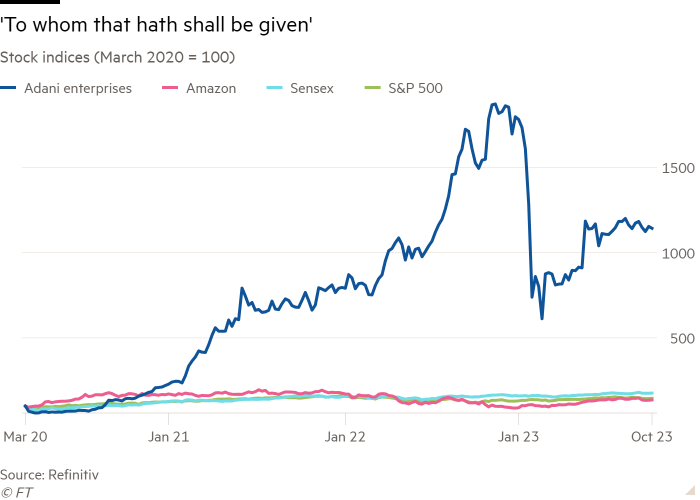

The concept that India can neatly substitute China as a development market, manufacturing hub and vacation spot for capital faces each political and financial query marks, as exemplified by the and Adani disaster on the financial/company facet and, on the geopolitical facet, the assassination in Canada of Sikh separatist Hardeep Singh Nijjar, which Canada’s prime minister Justin Trudeau has alleged was instigated by Indian brokers. For democratic governments and profit-seeking buyers, the query is identical: how dependable a associate is India? The China disappointment is contemporary in buyers’ minds. What regarded like a rising, liberalising, outward-facing economic system upset on all three fronts, leaving international capital nursing poor returns. Would possibly this sample be repeated in India?

At Unhedged, our focus is the funding story. It’s powerfully interesting. It has been a bitterly disappointing decade for rising market buyers. However the need to allocate a significant slice of portfolios to the rising world, as a supply of each diversification and development, stays. And the strongest purpose for weighing this slice in the direction of India is not only that the nation has averaged actual GDP development of greater than 6 per cent a 12 months for the previous 30 years; that development has additionally translated into inventory market returns in a approach that China’s development, for instance, has not. Over the previous 30, 20, 10 and 5 years, the Sensex has carried out as nicely or higher than the S&P 500, leaving different large markets far behind:

India’s development story is constructed on its outstanding improve in whole issue productiveness, the economic system’s skill to generate output from a given quantity of labour and capital. Aditya Suresh of Macquarie notes that TFP’s contribution to headline development has averaged 1.3 per cent between 2007 and 2022, in opposition to 0.9 in 1990-2006, far outpacing different EMs.

Partly, the TFP enhance has come from effectivity enhancements in sure sectors, resembling providers exports (suppose ecommerce or consulting). However the greatest enchancment is undoubtedly from higher fundamental infrastructure. The nation has, as an illustration, seen a serious buildout of seaports, railways, roads and airports, in no small half overseen by the Adani Group. Some concern a focus of financial energy, however Neelkanth Mishra, an economist at Axis Financial institution and an financial adviser to Modi, argues the typical Indian has profoundly benefited:

In 2011, two-thirds of households had electrical strains of their homes with 5 to 6 hours of electrical energy. Now, the share is within the 90 per cent vary, with 20 hours of electrical energy on common. [Such a massive improvement] allows you to examine at night time, or cool your self down, or use induction stoves . . . In 2011, two-thirds of households used firewood [or another organic fuel] to cook dinner! Now most use cooking gasoline.

Beneficial demography can be lifting India’s economic system. On present inhabitants estimates, the working-age share of inhabitants is anticipated to rise (and dependency burden fall) for a number of years. This helps offset India’s dismal feminine labour pressure participation and underemployment. Ought to these enhance, development might speed up additional. And even when the demographic dividend fades, India’s working-age inhabitants is poised for a “lengthy plateau” that might final many years, says Suresh, at a time when most different main economies face shrinking, ageing populations:

As India’s inventory market takes up a rising share of rising market indices, international investor cash has rolled in. However essentially the most enthusiastic patrons of Indian shares are Indians themselves. One type this takes is retail buyers swapping inventory suggestions in WhatsApp teams and driving hyped-up small-cap shares to ridiculous valuations. However one other is the regular rise of systematic funding plans, which put a preset sum of money out of your checking account into the inventory market. A gradual improve in these schemes has pushed home fairness flows for the previous few years (in inexperienced, under; chart from Macquarie):

A steady base of home fairness patrons is nice for international buyers. Some markets, like China, undergo from flighty retail buyers. Others, like Japan, simply have too few of them; households are within the mixture evenly allotted to shares.

If there’s a downside for India buyers, it’s that the story has turn out to be too standard. The shares look costly. At a worth/earnings ratio of 23, the Sensex is close to the highest of its historic vary and at a premium to the US, world and EM indices. As Morgan Stanley’s Jitania Kandhari put it to us, somewhat delicately, Indian shares are “priced for an excellent final result”. The current rally in Indian small-cap and lower-quality shares appears downright irrational. The India story, in brief, seems overbought — not an enormous fear for long-term buyers however clearly price preserving in thoughts for these looking for an entry level.

Our query for you, Adam, is whether or not the Indian geopolitical story is equally overbought. The worldwide romance with China — or at the very least the thought of China — appears to be ending in heartbreak. Are the world’s excessive hopes for India headed for the same disappointment?

Chartbook: Indian development is unbalanced and cronyist

The transformation of on a regular basis life in India is simple and dramatic. Electrification, clear water and first rate bathrooms for lots of of thousands and thousands of individuals are enormous achievements. Bharatiya Janata occasion prime minister Modi is a consummate politician and has skilfully put his private stamp on a collection of developments that had been years within the making.

However while Modi’s programme sails underneath the flag of nation constructing, the advantages of India’s development have been distributed shockingly unequally. Whereas the share of GDP going to the highest 1 per cent grew in China between the Nineteen Eighties and the 2010s from 7 per cent to 13 per cent, in India it rose from 10 per cent to 22 per cent. India right now is extra unequal than post-apartheid South Africa and in the identical ballpark as Putin’s Russia.

Sure, there’s an Indian higher center class that invests within the native inventory market and that group is rising. Nevertheless it accounts for 3 per cent of India’s inhabitants. By comparability, 13 per cent of Chinese language maintain some funding within the inventory market, as do 55 per cent of Individuals. And, as we all know from the US, the overwhelming majority of these retail buyers have tiny holdings.

By far the largest beneficiaries of India’s inventory market increase are the political insiders who’ve ridden a well-founded wave of confidence within the energy of their political connections. Greatest linked of all is Gautam Adani, whose relationship with Modi goes again to the aftermath of the bloody Gujarat riots.

Billionaire households just like the Adanis and Ambanis are Modi’s companions in state constructing. What they don’t seem to be is globally aggressive manufacturing entrepreneurs. Within the Nineteen Eighties India misplaced out to China as a base for manufacturing globalisation. A era later, India once more did not capitalise, this time on rising labour prices in China. Bangladesh was way more entrepreneurial and now boasts a better GDP per capita.

In coming years, evidently India could profit from diversification away from China pushed by nationwide safety considerations. Apple is essentially the most spectacular case. However how far that’s going to go stays to be seen. Up to now it’s Apple’s Chinese language provide chain consultants and engineers who’re key to getting the Indian manufacturing up and operating.

Political connections could not provide the technological edge. However what they do ship is straightforward credit score. India’s development has been closely debt fuelled. In the present day it’s Adani’s monetary engineering that makes the headlines. However if you happen to bear in mind again to earlier than the coronavirus pandemic, India was within the grips of a widespread financial institution disaster. Raghuram Rajan took on the job as governor of the Reserve Financial institution of India within the hope of cleansing home. By 2016 he was gone.

A jaundiced view of Indian capitalism, resembling that supplied by Jairus Banaji, sees this merely as the most recent iteration of struggles between completely different enterprise teams and politicians, a cycle that has repeated for the reason that Nineteen Thirties. Within the present second there’s a pure match between the “promoter” mannequin of capitalism personified by Adani and Modi’s populism.

The extra alarmist imaginative and prescient, supplied by Ashoka Mody in his highly effective evaluation India is Damaged, is that India is within the late levels of a failed undertaking of nation constructing. And the last word take a look at of this thesis is to not be discovered within the inventory market, or the within battles between enterprise teams, however within the human capital endowment of the broad mass of India’s inhabitants.

In 2020 on the World Financial institution’s Human Capital Index — which measures international locations’ training and well being outcomes on a scale of 0 to 1 — India achieved a rating of 0.49, under Nepal and Kenya, each poorer international locations. China scored 0.65, placing it on par with Chile and Slovakia, which have larger GDP per capita. Most dramatically deprived are India’s ladies. Since 1990, Indian ladies’s labour market participation has fallen from 32 per cent to about 25 per cent. And behind them come lots of of thousands and thousands of underskilled kids. In 2019 lower than half of India’s 10-year-olds might learn a easy story, in contrast with greater than 80 per cent of Chinese language youngsters and 96 per cent of Individuals. Within the coming decade, 200mn of those poorly educated younger folks will attain working age. A big share of them will in all probability find yourself eking out a residing within the casual sector and getting by on handouts. Unemployment amongst the under-25s already runs at greater than 45 per cent.

On the G20, India trumpeted its investments in public sector tech infrastructure. However spectacular as they might be, are these helpful apps for the supply of money and digital providers not a approach of bypassing the troublesome enterprise of constructing efficient authorities and really empowering India’s big inhabitants? As Yamini Aiyar argues, regardless of India’s progress on many metrics, a substantive welfare state stays an phantasm.

Indian intellectuals of the subaltern research college used to lament that India, in contrast to China, by no means had a real peasant revolution and the deep social and cultural transformation that may have adopted. In the present day, within the face of the BJP’s onslaught, you hear Indian liberals questioning the identical factor. That’s the dramatic historic counterfactual implied by seemingly matter-of-fact comparisons with China.

Clearly, in profound methods India’s path is neither that of China, nor that of the west. Trying to the long run, what sceptics of Modi’s boosterism ask is whether or not India may turn out to be the forerunner of a somewhat gloomy new mannequin for populous, lower-income international locations, managed, and not using a powerfully efficient governmental equipment, or globally aggressive manufacturing sectors, by digitally enhanced populism, delivering money funds by mobile phone to lots of of thousands and thousands of dependent folks. And because the occasions in Manipur expose, when all else fails, that welfarism might be backed up by mob violence and a dose of harsh repression.

We don’t consider India as a frontrunner in high-tech surveillance, like China. However the flipside of a digitally enabled welfare system is that an web blackout is a terrifying weapon. And as Human Rights Watch notes, since 2018 the authorities in India have shut down the web extra typically than in some other nation on this planet.

The world proper now’s a troublesome place. In want of a counterweight to China, the Biden administration appears decided to embrace India at any worth. Buyers could really feel the identical approach. It’s a large economic system, now bigger than that of the UK, and a massively numerous and inventive society. Little doubt there are methods to earn money. However buyers must be clear eyed about what they’re getting themselves in to.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Take heed to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the most recent markets information and monetary headlines, twice per week. Make amends for previous editions of the publication right here.

Advisable newsletters for you

Swamp Notes — Knowledgeable perception on the intersection of cash and energy in US politics. Enroll right here

Chris Giles on Central Banks — Your important information to cash, rates of interest, inflation and what central banks are considering. Enroll right here